Your next hire is out there for as low as $10.57/hr USD.

We'll help you hire an E-commerce Fraud Analyst for significantly cheaper than hiring a US employee.

or 📞 call our office anytime, (860) 500-1469

Why hire with The People Company?

Low cost by hiring from the Philippines and Latin America

Your company's next e-commerce fraud analyst lives in the Philippines or Latin America, but has a great understanding of Western work culture!

Speaks incredible English

All of our hires speak English at a C2 level or above -- the highest level of qualification provided by the Cambridge Assessment.

Years of experience being an e-commerce fraud analyst

The average candidate we place has 7+ years of experience working for US companies as an e-commerce fraud analyst. You'll get someone who can hit the ground running!

or 📞 call our office anytime, (860) 500-1469

Stop overpaying for labor, and come join The People Company!

🤢 $5,000 USD per month

average 🗽 US salary

🇵🇭 $1,860 USD per month

average Philippine salary for e-commerce fraud analysts

🇻🇪 🇦🇷 🇲🇽 $2,232 USD per month

average LatAm salary for e-commerce fraud analysts

From $10.57/hr, all-in. No upfront fees, our fee is included in the rate.

$0 – your new hire’s first week. We pay their salary while you get comfortable with them.

$0 – payroll tax, workman’s comp, unemployment insurance, benefits, etc. or anything else you have to pay with a US employee.

$0 – onboarding fees. We give each customer personalized, white-glove service.

$0 – recruiting fees. We seek out, interview, and vet your new hire for free.

$0 – payroll & global compliance. We take care of all of the headache that comes w/ hiring someone internationally.

$0 – unlimited support. Get unlimited phone & email support with managing/onboarding your hire.

or 📞 call our office anytime, (860) 500-1469

How does it work?

1. Hop on a call

We’d hop on a phone call and get a little more context as to what you and your team are spending their day on, and what you’d like to outsource.

We’ll use this data to find the perfect assistant (or assistants, depending on your org size!)

Timeframe: 1-2 days

2. We headhunt

Our headhunter would take the data from our phone call and find candidates from our talent pool with experience in supporting teams in your industry.

Bonus points for experience with your CRM and tools, and a great culture fit.

Timeframe: 2-3 days

3. Interview & trial

We’ll present three compelling candidates and you can interview as many of those as you’d like. When you’ve found a great assistant, we will pay their first week’s salary so you can be confident they’ll be a value-add.

If they’re not a good fit, we’ll work night and day to find someone who is.

Timeframe: 7 days

Expect e-commerce fraud analysts that can fit this job description:

They'll have proficiency in these tasks:

-Review flagged orders, analyzing transaction details and customer information to determine the likelihood of fraud.

-Conduct in-depth investigations into high-risk transactions, gathering evidence and using analytical tools to confirm fraudulent behavior.

-Collaborate with customer service teams to verify customer identities when fraud indicators arise.

-Utilize fraud detection software and machine learning models, adjusting settings and rules to improve accuracy over time.

-Analyze historical fraud data, identifying trends and patterns to enhance preventive measures.

-Report findings on fraud cases, documenting all relevant details and communicating with management on emerging risks.

-Communicate with banks and payment processors to address chargebacks and resolve disputed transactions.

-Develop and update fraud prevention policies, ensuring compliance with industry regulations and company standards.

-Perform risk assessments on new payment methods or processes to ensure they meet fraud prevention criteria.

-Educate and train team members on fraud prevention best practices, keeping the organization informed of the latest tactics and trends.

-Collaborate with cybersecurity and IT teams to enhance security protocols and protect sensitive customer information.

They'll know how to handle these responsibilities:

-Investigate high-risk orders, analyzing customer and transaction data to assess the likelihood of fraudulent behavior.

-Collaborate with customer support to verify details on flagged transactions, ensuring the accuracy of assessments.

-Use fraud detection tools and adjust settings to improve detection rates and minimize false positives.

-Report on fraud patterns and findings, providing actionable insights to management for risk mitigation.

-Manage chargebacks and disputes, coordinating with payment processors and banks to resolve cases.

-Develop and update fraud prevention protocols, keeping the organization aligned with industry best practices and compliance standards.

They'll have these qualifications:

-Experience in fraud detection or risk management in e-commerce

-Proficiency with fraud detection tools (e.g., Riskified, Signifyd, Kount)

-Strong analytical and problem-solving skills

-Knowledge of payment processing and chargeback procedures

-Ability to analyze data for fraud patterns and trends

-Excellent attention to detail and decision-making abilities

They'll be proficient in your 'tech stack', which may include:

or 📞 call our office anytime, (860) 500-1469

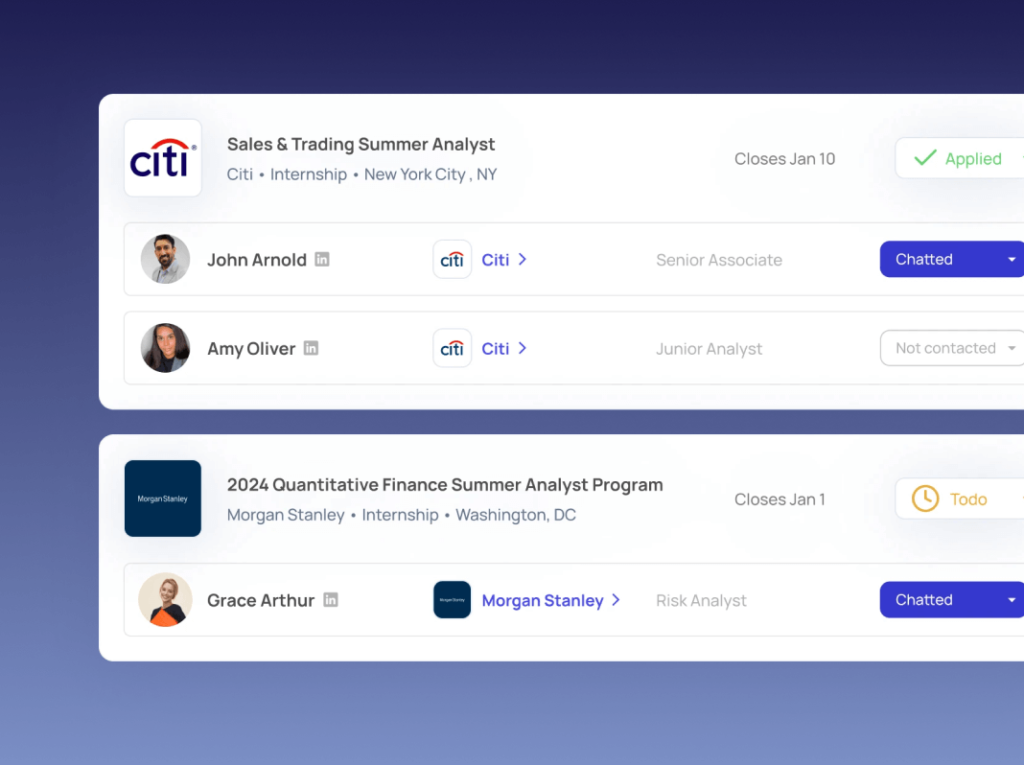

RecruitU hires great team members at 18% of the US cost with The People Company

RecruitU used The People Company to place Rico, an administrative assistant who took off vital business processes. This saved the founders a ton of time and allowed them to focus on ‘more important’ work.

Brooks Gammill, Co-Founder at RecruitU

⭐⭐⭐⭐⭐ "Hiring Rico through The People Company has been an absolute game changer. Since onboarding Rico I can now spend more time on sales and prospecting knowing that my all my administrative tasks are dealt with"